The SEEK Advertised Salary Index (ASI) measures the growth in advertised salaries for jobs posted on SEEK in Australia. This report examines national trends up to the month of August 2023. The next quarterly SEEK ASI report will be released in November and will contain industry and state trends.

NATIONAL ADVERTISED SALARY TRENDS

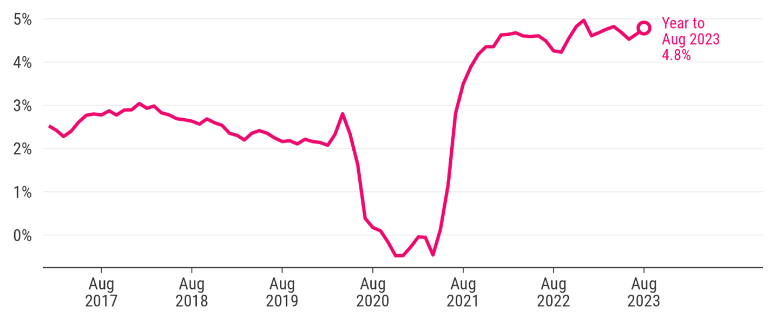

- The SEEK ASI rose 4.8% over the year to August 2023, more than the 4.6% increase in the year to July.

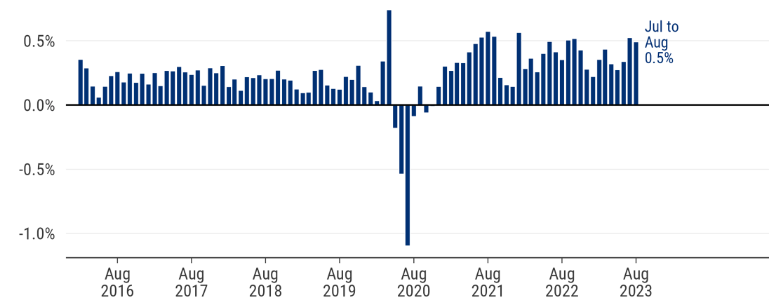

- Advertised salaries grew by 0.5% month-on-month (m/m) in August, following a rise of the same amount in July.

- The latest m/m rise was an increase from the 0.3% recorded in April, May, and June.

SEEK Senior Economist, Matt Cowgill, says:

“We’re nearly at a point where advertised salary growth is outpacing the cost of living, with the SEEK ASI up 4.8% in the year to August and inflation up 4.9% in the year to July.

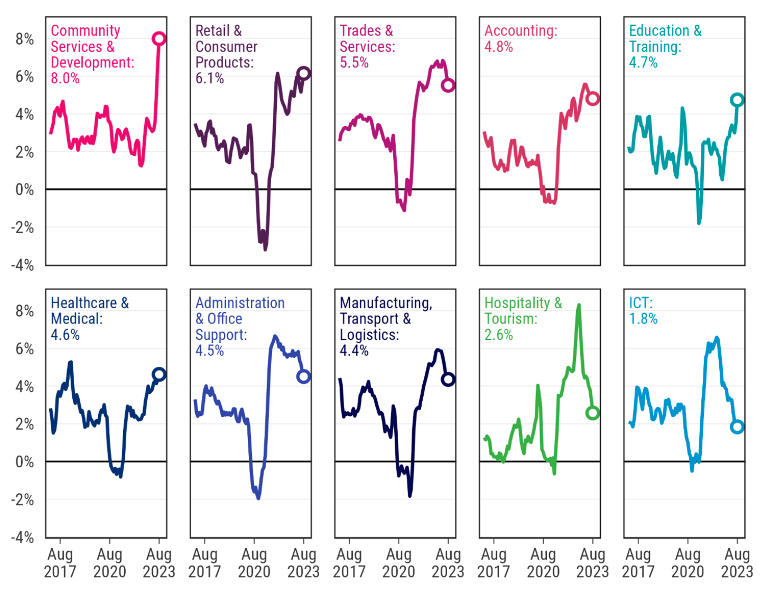

“However, this increase is not common across all industries - most are still seeing moderate growth after the highs of 2022."

“The increase in the overall ASI has been driven in large part by the Community Services & Development industry, where minimum wages for certain occupations in aged care have increased by 15%.

“Given that the pick-up is not common across many industries, the acceleration in the ASI is unlikely to continue in future months.”

Figure 1: Annual growth of SEEK ASI

Figure 2: Monthly growth of SEEK ASI

WHAT IS CAUSING WAGES TO RISE NOW?

Just a few months ago the ASI appeared to have peaked and was slowing. That has now turned around, with the ASI up by 1.4% in the three months to August. The 0.4% m/m figure previously reported for July has now been revised up to 0.5%, and August followed with a further 0.5% growth.

Why has advertised salary growth picked up again after starting to ebb? The growth appears to be confined to only some industries, in particular Community Services & Development, which has experienced a relatively large increase in minimum rates of pay due to a Fair Work Commission decision.

Figure 3 shows growth in the ASI by industry for the top 10 industries [1]. Community Services & Development stands out, with 8.0% growth in advertised salaries in the year to August. Most other large industries are seeing a slowing of ASI growth – for example, the Trades & Services industry experienced 5.5% growth in the year to August, down from a peak of 6.8% in the year to April 2023.

Notably, Hospitality & Tourism has seen a continued moderation in ASI growth, with advertised salaries up just 2.6% in the year to August. Hospitality is the industry in which the largest proportion of employees are paid according to an award [2] Modest advertised salary growth has persisted in Hospitality despite the Fair Work Commission’s decision to lift award wages by 5.75% from July. This moderation in advertised salaries reflects a fall in labour demand in Hospitality from the very hot labour market experienced in 2022.

Figure 3: Annual growth of SEEK ASI by industry (top 10 industries shown)

THE SUB-INDUSTRIES DRIVING GROWTH

Within the Community Services & Development industry, the rise in advertised salary growth appears to be confined to the Aged & Disability Support sub-industry, which experienced a rise of 8.9% in the year to August. Other sub-industries, such as Employment Services and Community Development are seeing reasonably steady growth in advertised salaries, without the sharp increase in recent months experienced by Aged & Disability Support.

This lends weight to the view that the overall increases in ASI for Community Services & Development has been driven by the Fair Work Commission’s decision to increase aged care award wages by 15 per cent from 30 June for a range of key occupations.[1]

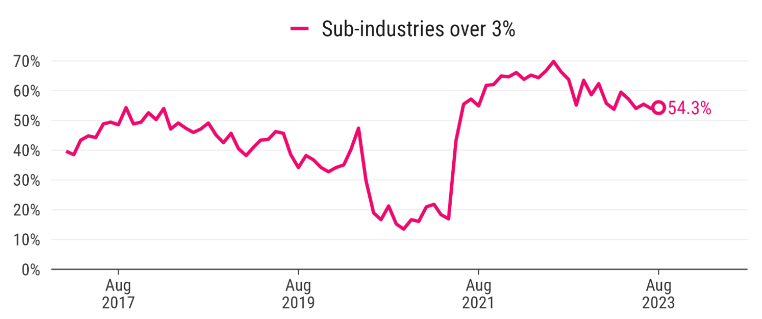

The increase in ASI growth has not been broad-based. In the year to August, only 54% of the nearly 400 sub-industries recorded by SEEK experienced advertised salary growth of 3% or greater, as shown in Figure 4. This has fallen from a peak of 70% of sub-industries in the year to June 2022, when the demand for labour was at its strongest, and has fallen reasonably steadily since that peak.

Given that the rise in ASI has been driven by only a portion of sub-industries, and that the greatest growth is due to a one-off increase in award wages, it would be reasonable to expect growth in the overall ASI to moderate again, now that the temporary effects of the one-off aged care wage increase have passed.

Figure 4: Annual growth of SEEK ASI for subindustries over 3%

About the SEEK ASI

The SEEK ASI measures the change in advertised salaries over time for jobs posted on SEEK in Australia, removing much of the effect of compositional change. The SEEK ASI is a complement to existing data about the growth in wages and salaries in Australia, including the ABS Wage Price Index (WPI). The WPI is a measure of the pace of wages growth across the economy, for jobs that are currently occupied. The SEEK ASI provides a timely and frequent read on the pulse of advertised salary growth in Australia for vacant roles.

More information about how the SEEK ASI is put together can be found here. The data for the SEEK ASI can be found here.

Disclaimer

The data should be regarded as standalone information and should not be aggregated with any other information.The data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed on the data, or from the use of the data.